Word Category: Finance

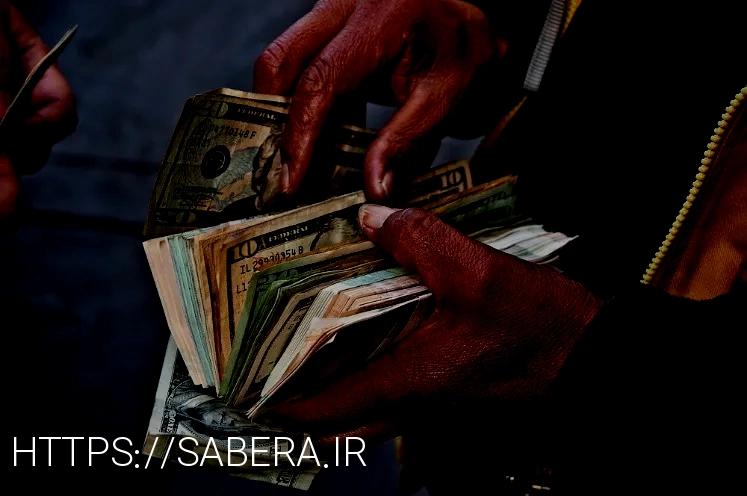

Money exchanges play a crucial role in the global economy, facilitating the exchange of currencies between individuals, businesses, and governments. Whether you are a seasoned traveler looking to convert your dollars into euros or a savvy investor keeping an eye on exchange rates, understanding how money exchanges work is essential.

At its core, a money exchange is a service that allows you to swap one currency for another at an agreed-upon rate. These rates fluctuate constantly based on a variety of factors, including interest rates, geopolitical events, and economic indicators. As a result, keeping tabs on exchange rates and trends can help you make informed decisions when buying and selling currencies.

One common question that arises when discussing money exchanges is, “How do I find the best exchange rate?” The answer to this question can vary depending on the method you choose to exchange your money. Whether you opt for a physical exchange bureau, a bank, or an online platform, it’s important to compare rates and fees to ensure you are getting the best deal.

Additionally, people often wonder about the risks involved in money exchanges. While exchanging money can be a straightforward process, it’s essential to be aware of potential scams and fraudulent practices. By conducting thorough research and working with reputable exchange providers, you can minimize these risks and enjoy a seamless exchange experience.

Strategies for Conquering Money Exchange Hurdles

Navigating the world of money exchanges can be a daunting task, filled with challenges and uncertainties. One common issue faced by individuals is fluctuating exchange rates, which can greatly impact the value of their currency. This unpredictability can make it difficult to accurately budget and plan for financial transactions. To overcome this challenge, one strategy is to stay informed about market trends and seek out the best exchange rates through comparison tools or apps.

Another obstacle in the realm of money exchanges is hidden fees and charges. Many financial institutions and exchange services may tack on additional costs, eating into the overall value of the transaction. To combat this, individuals can research different exchange methods and choose ones with transparent fee structures. Additionally, negotiating with service providers or using peer-to-peer exchange platforms can help minimize unnecessary costs.

Furthermore, security concerns surrounding money exchanges can pose a significant challenge. With the rise of online scams and fraudulent activities, it’s crucial for individuals to prioritize safety when transferring funds. Utilizing reputable and secure platforms, implementing strong password protection, and verifying the legitimacy of exchange services are essential steps in safeguarding financial transactions. By proactively addressing these challenges and implementing strategic solutions, individuals can navigate the complexities of money exchanges with confidence and ease.

Revolutionizing the Money Exchange Industry: Innovative Solutions

In today’s global economy, navigating the world of money exchanges can be a challenging task. Whether you are a frequent traveler, an international business owner, or simply someone looking to send money overseas, finding the most efficient and cost-effective way to exchange currencies is crucial. Fortunately, there are several innovative solutions that can help you overcome the obstacles associated with traditional money exchange methods.

One such solution is the rise of digital currency exchange platforms. These online platforms offer a convenient and secure way to exchange currencies, allowing users to easily compare rates and make transactions from the comfort of their own homes. By leveraging technology, digital currency exchange platforms are able to offer competitive rates and lower fees than traditional brick-and-mortar exchange services.

Another innovative solution is the use of peer-to-peer currency exchange networks. These networks connect individuals looking to exchange currencies directly with one another, cutting out the middleman and reducing costs. By leveraging the power of community and technology, peer-to-peer currency exchange networks offer a more personalized and cost-effective way to exchange money.

Overall, by embracing innovative solutions such as digital currency exchange platforms and peer-to-peer currency exchange networks, individuals and businesses can navigate the world of money exchange port coquitlam with greater ease and efficiency. As the industry continues to evolve, staying informed and open to new approaches will be key to ensuring success in the complex world of international finance.

Exploring the Depths of Money Exchanges

Money exchanges are not just about converting currency; they symbolize the interconnectedness of global economies and the impact of financial decisions on individuals and nations. In a world where wealth disparities are widening, money exchanges play a crucial role in shaping economic stability and social equity. While they offer hope for facilitating international trade and fostering economic growth, they also reveal the underlying power dynamics and inequalities present in the financial system.

As we navigate the complexities of money exchanges, it is essential to consider not only the economic implications but also the ethical and social consequences of our financial transactions. By critically examining the nature of money exchanges, we can strive for a more equitable and sustainable financial future. Let us challenge ourselves to think beyond profits and delve into the deeper meanings behind our monetary interactions, fostering a greater sense of responsibility and empathy in our financial decisions. Through reflection and action, we can transform money exchanges from mere transactions into opportunities for positive change and empowerment.

| Solutions | Challenges |

|---|---|

| Increased Transparency | Regulatory Compliance |

| Efficiency in Transactions | Security Concerns |

| Lower Costs | Exchange Rate Fluctuations |

| Enhanced Customer Experience | Competition from Online Platforms |

Word Category: Finance